Controllership accounting is one of the most important yet misunderstood pieces of a startup’s financial journey.

Scaling a business is exciting and messy at the same time, and founders often find themselves buried in spreadsheets, racing to prepare board decks, or scrambling to process payroll across multiple states.

At first, basic bookkeeping may be enough. But as soon as transactions multiply, investors enter the picture, and compliance rules get complicated, bookkeeping alone can’t keep pace. That’s when controllership accounting becomes essential.

This guide explains what controllership accounting is, how it differs from bookkeeping and CFO work, and why it matters earlier than most founders realize.

We’ll also explore how EOS® companies integrate controllership, the role of technology, and the common mistakes controllership prevents—drawing on lessons from our work with fast-growth startups.

What Is Controllership Accounting?

Controllership accounting is the oversight function within your finance team that ensures accuracy, compliance, and reliability across all financial operations.

While accounting documents what happened, controllership ensures those numbers are correct, processes are consistent, and results can withstand scrutiny from investors, lenders, or auditors.

A controller—or outsourced controllership team—typically manages:

- Internal controls and financial processes

- Spend management and budgeting

- Timely closes and reconciliations

- Compliance with tax and reporting requirements

- Analysis and reporting to guide decision-making

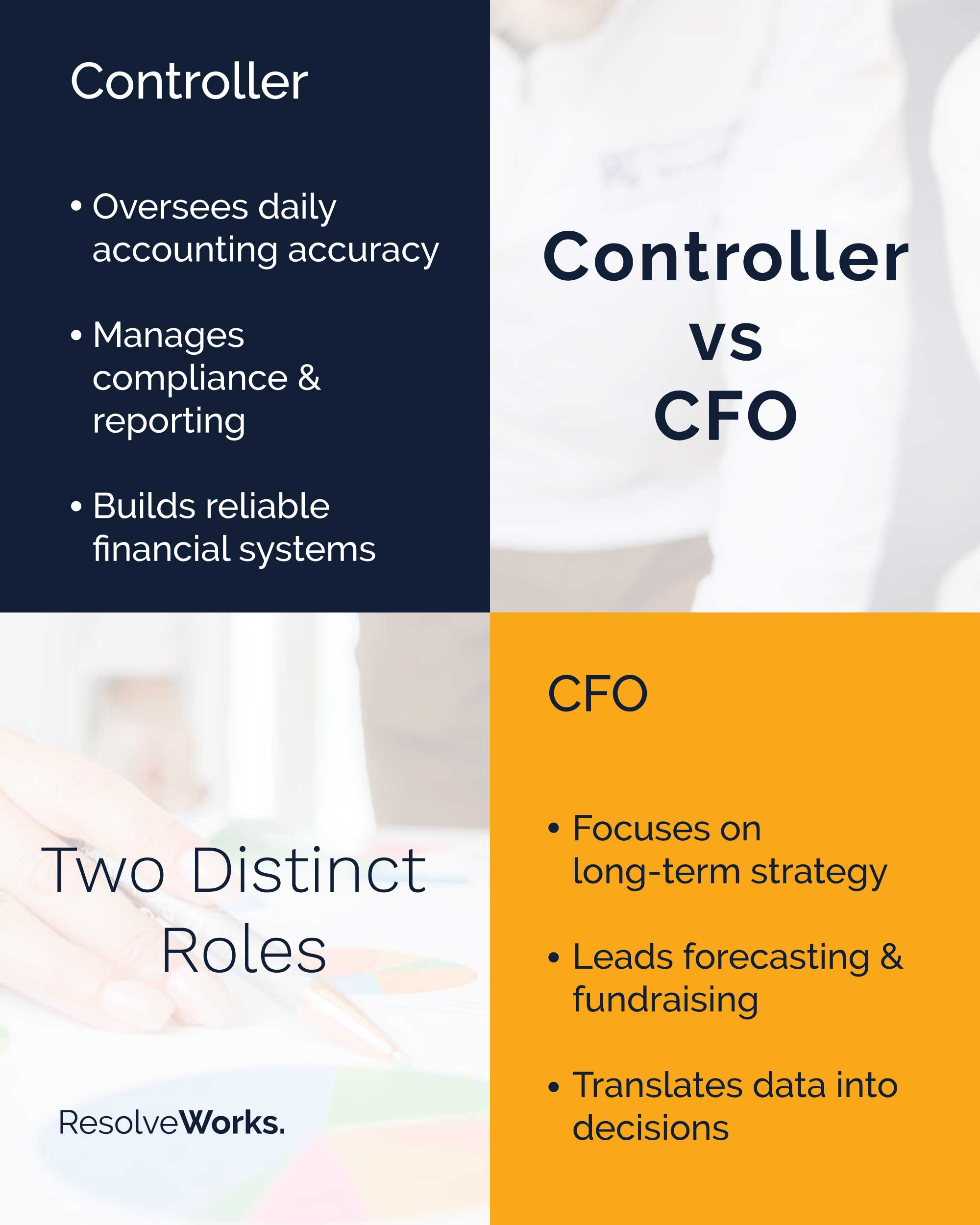

Controller vs. CFO: Two Distinct Roles

Founders also ask: how does a controller differ from a CFO?

A Controller manages controllership accounting, ensuring financial reporting, compliance, and day-to-day accuracy.

A CFO provides long-term financial strategy, scenario modeling, and fundraising support.

The two roles are complementary. A controller provides the foundation of reliable data; a CFO turns that data into strategy. Many scaling startups outsource both functions, benefiting from accuracy and forward-looking guidance without the cost of two full-time hires.

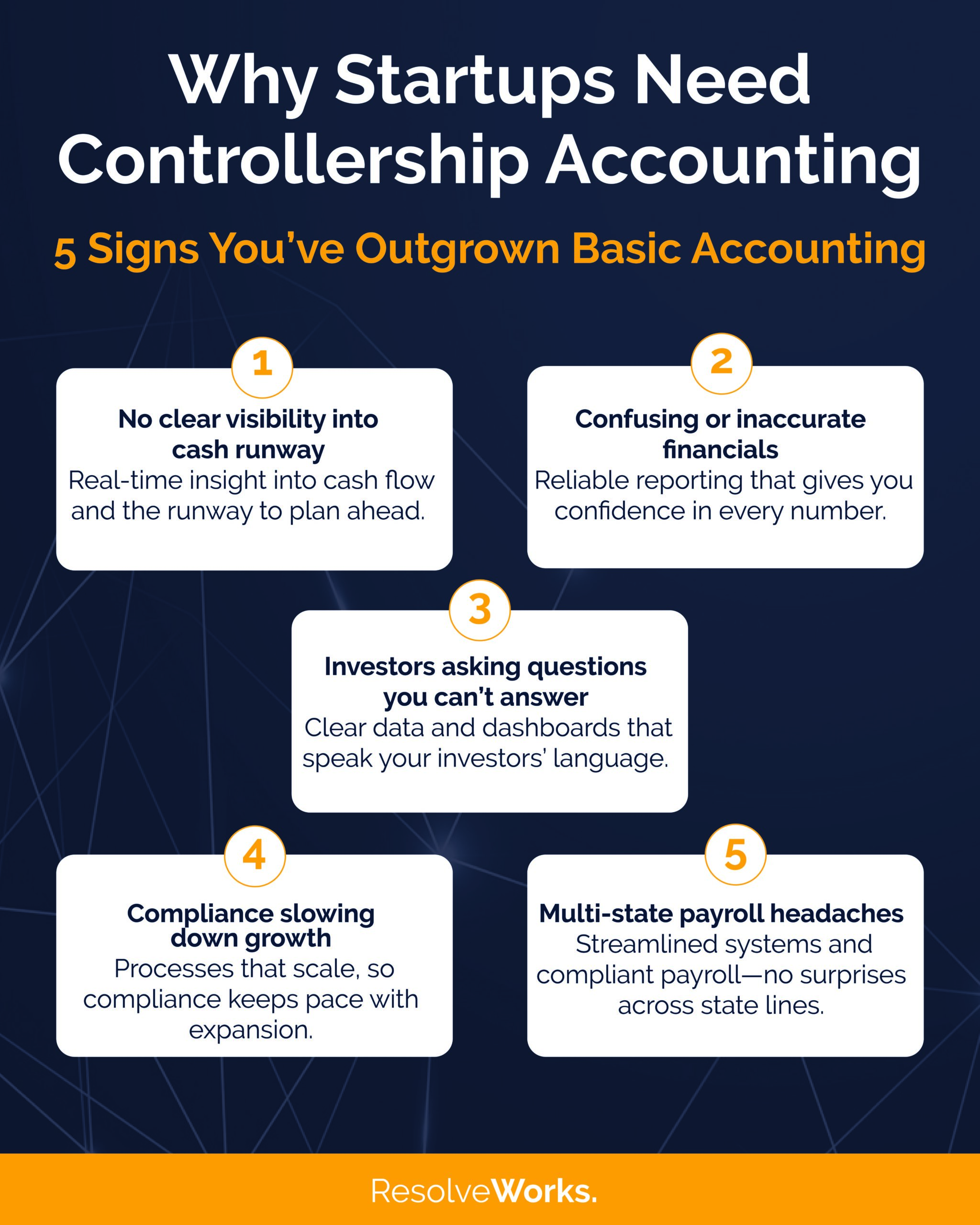

Why Startups Need Controllership Accounting Sooner Than They Think

Most founders assume controllership accounting is something they’ll add after a major fundraising round or once headcount reaches 50+. In practice, the need shows up much earlier—and ignoring it can lead to costly mistakes.

From our work with growth-stage clients, here are the most common signs and pitfalls:

Lack of Visibility into Cash Runway

Without a clear understanding of current and future cash needs, growth-stage companies can quickly and surprisingly run out of cash. A controller will monitor both short-term and long-term cash needs to help plan for near-term operational needs, as well as the long-term investment horizon.

Accuracy and Consistency of Financial Reporting

Without controllership oversight, it’s common for there to be errors in financial reporting. This could include unexplained swings in revenue or expenses, not treating accruals and deferrals properly, and not capturing expenses or revenue in the correct period.

Visibility into Performance

Alongside lack of accuracy in reporting comes a lack of understanding of business performance and the levers driving it. A P&L that contains errors may not provide clear visibility into profit margins, resulting in leadership & investors not being able to make informed decisions.

Sales Tax Compliance

Similar to payroll compliance, sales tax compliance becomes increasingly complex when sales expand across state lines, triggering economic nexus in addition to physical nexus that occurs with hiring remote workers. A controller will monitor nexus events, track taxability of sales on a per-state basis, and ensure sales tax is being charged properly on sales.

Multi-state payroll & compliance

Hiring across state lines requires registrations for state withholding and unemployment. Without controllership oversight, compliance gaps quickly turn into penalties.

In short: controllership accounting doesn’t just keep the books clean—it prevents small missteps from becoming expensive distractions, safeguards credibility with employees and investors, and sets your company up for sustainable growth

Real-World Examples of Controllership Accounting in Action

To see how controllership accounting prevents these issues in practice, here are two real-world examples from clients we’ve supported through rapid growth and compliance challenges.

Case Study 1: Controllership Accounting for Healthcare Startup (Series B Growth)

From founder-led bookkeeping to a fully supported finance team.

We began working with a healthcare startup preparing for its Series A round, managing bookkeeping in-house. As growth accelerated, our team implemented month-end close processes, multi-state payroll, digital AP, and weekly cash forecasts.

Today, we collaborate daily with their internal CFO and provide:

- Consolidated reporting across nine entities in five states

- Budgeting and cash-flow forecasting to plan Series B and future financing

- AP, payroll, and investor equity management at scale

Case Study 2: Controllership Accounting for SaaS Company (Series B Compliance & Reporting)

A proactive fix to a major compliance risk.

When this SaaS client engaged us, books weren’t closing on time and sales tax exposure spanned 20 states. We established a month-end close process and led a full economic nexus review—completing VDAs that waived $40K in penalties.

Ongoing support includes:

- Sales tax registration and Avalara integration across 1,600+ monthly invoices

- Monthly close reporting to the CFO for board and investor use

Controllership Accounting and EOS®: Owning the Finance Seat

For EOS® companies, controllership accounting is about numbers and traction.

- A controller anchors the Finance Seat by:

- Delivering accurate, timely data for Level 10 Meetings®.

- Translating Rocks (90-day priorities) into budget and cash flow impacts.

- Ensuring processes are “Followed by All” with documented, repeatable workflows.

- Supporting the Six Key Components® of the EOS® Model: Vision, People, Data, Issues, Process, and Traction.

By aligning controllership accounting with EOS®, finance becomes a driver of clarity, accountability, and execution.

Technology’s Role in Controllership Accounting

Modern controllership is as much about systems as it is about numbers. Without oversight, startups often end up with a patchwork of tools—payroll here, AP there, expense management somewhere else—that don’t talk to each other.

Controllers prevent that by:

- Vetting and testing financial technology tools before rollout.

- Integrating systems across payroll, AP, GL, and reporting platforms.

- Monitoring syncs for accuracy and catching errors early.

- Owning data quality across the finance stack.

Example: Without integration, employee hours may be entered manually into spreadsheets, leading to payroll errors. With controllership accounting, those hours flow seamlessly into payroll and accounting software—reducing rework and ensuring accuracy.

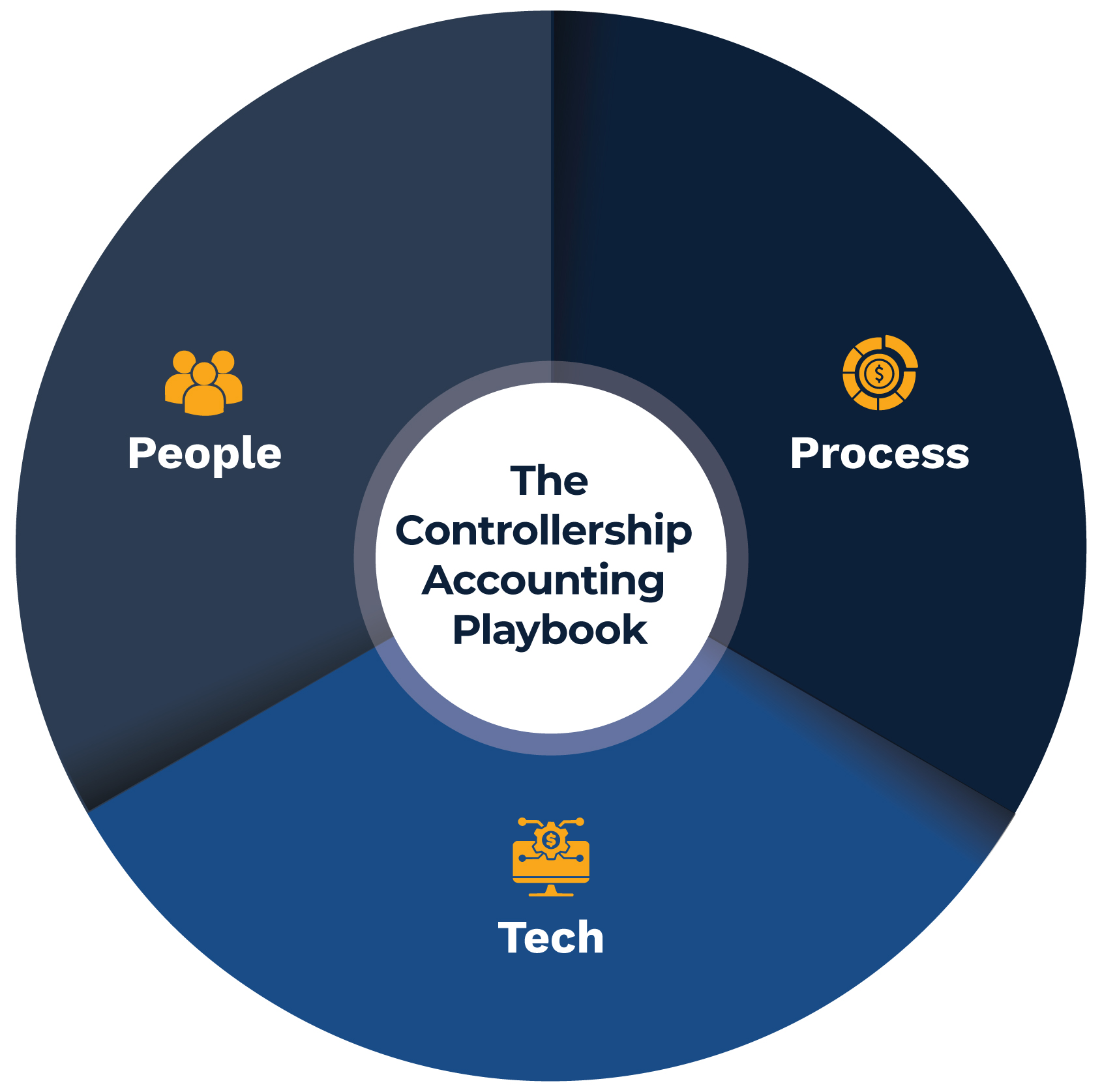

People, Process, Tech: The Controllership Accounting Playbook

Controllers don’t just “check the books.” They design the ecosystem that financial data flows through.

People

- Clarify finance-related roles and approvals.

- Implement structured onboarding so new hires are enrolled in payroll, benefits, and systems consistently.

Process

- Document close checklists, AP approvals, and spend policies.

- Regularly audit and update procedures—“set and forget” is a recipe for errors.

- Involve staff in shaping processes, creating accountability and buy-in.

Tech

- Choose integrated financial systems that scale with headcount.

- Automate recurring steps but maintain human oversight for exceptions.

This combination—people, process, tech—is the hallmark of effective controllership accounting.

How Controllership Accounting Supports Payroll and Benefits

Competitive benefits attract talent, but they also create financial complexities. Controllers ensure benefits and payroll tie back to clean, reliable financial data.

- Health and retirement plans → Controllers manage accruals, employer match entries, and compliance filings.

- PTO policies → Controllers track accruals and ensure they appear correctly on financial statements.

- Stock options and equity → controllers account for vesting and expense recognition.

- Wellness stipends or unique perks → controllers ensure tax treatment is accurate.

Without controllership accounting, benefits can become a messy source of errors. With it, they become both a recruiting tool and a clean line item on the books.

FAQs About Controllership Accounting

The Future of Controllership Accounting

Automation and AI will keep eliminating clicks: invoices posting directly to the GL, dashboards refreshing in real time, payroll syncing instantly with accounting. But none of that replaces the human judgment and oversight of a controller.

In fact, as systems integrate more tightly, controllership accounting becomes more valuable. It ensures the exceptions—the 2% of cases automation can’t handle—don’t derail the other 98% of your financial operations.

Controllership accounting sits at the crossroads of accuracy and strategy. It ensures your numbers are reliable, your processes are scalable, and your leadership team can make decisions with clarity.

At Resolve Works, we specialize in helping ambitious entrepreneurs scale smarter. From bookkeeping to controllership to CFO advisory, we provide a finance function that grows with you.

Book a complimentary assessment to see how controllership accounting can strengthen your business today—and prepare you for tomorrow.

For startups ready to scale with confidence, controllership accounting is the foundation that makes growth possible.

When to Add Controllership Accounting

Not sure if you’re ready? Look for these signals:

- Financials aren’t ready when leadership needs them.

- Board prep feels rushed and reactive.

- You lack visibility into cash flow or runway.

- Multi-state payroll has become confusing.

- Multi-state sales tax compliance has become confusing.

- Policies for PTO, benefits, or expenses are inconsistent.

- Compliance questions slow down hiring or fundraising.

If two or more apply, you’ve likely outgrown basic accounting. Controllership accounting will save you money by preventing costly fixes later.

About Resolve Works

Resolve Works specializes in providing outsourced accounting to serve the unique needs of early to mid-stage startups, and companies running on the Entrepreneurial Operating System® (EOS®).

We work with fast-growth companies that are committed to the quest for clarity, information, efficiency, and focus. We are energized by visionary organizations that are growing quickly, moving fast, and need a team that can seamlessly step into the accounting seat, making an immediate impact.